What is the SACS Foundation?

Established in 2015, the San Antonio Christian School Foundation is a separate 501(c)(3) nonprofit dedicated to managing endowments and planned giving to support SACS students, teachers, and programs.

Donors benefit from enhanced investment potential and the assurance that funds are used as designated, advancing both the mission of SACS and Vision 2030, our strategic plan focused on Spiritual Development, Academic Distinction, Christian Community & Service, and Stewardship of Finances & Facilities.

The Foundation exclusively raises, invests, and distributes funds to ensure that current and future generations of students flourish in a Christ-centered environment. To learn more about the impact of your giving or Vision 2030, please contact the Advancement Office—we’d love to share more!

Support the Future

Foundation gifts provide long-term support for SACS through financial agreements between donors and the SACS Foundation. Planned gifts not only benefit SACS students but can also strengthen your personal financial situation. Our Foundation team collaborates with you, your attorney, and your financial advisor to create a tailored gift plan. Explore options for current, after-lifetime, and dual-benefit gifts below.

Current Gifts

Cash

Check, credit card and electronic funds make a quick and easy gift. Write a check, give online or set up a funds transfer to the SACS Foundation.

Securities

Gifts of publicly held stocks, closely held stocks, bonds, and mutual funds avoid capital gains when securities are transferred to the SACS Foundation.

Real Estate

Gifts of home, oil and gas royalty interests, vacation property, commercial property and land generate tax benefits through a property gift to the SACS Foundation.

Term Royalty Deed

Generate tax benefits through a temporary transfer of mineral royalties to the Foundation.

Intangible Property

Generate tax benefits by donating patents, copyrights, royalties, and other intangible property to the Foundation.

Donor-Advised Fund

Receive maximum tax benefits now and recommend charitable grants when and where you choose.

After-Lifetime Gifts

Bequest

Control assets during your lifetime and designate the Foundation as a beneficiary in your will or living trust. Please contact a SACS Foundation representative for suggested bequest language.

Retirement Account

Designate the Foundation as a beneficiary of your retirement account and avoid double taxation on your retirement assets.

Life Insurance

Change the beneficiary or transfer ownership of your life insurance policy to the Foundation and make a gift without using current assets.

Testamentary Charitable Remainder Unitrust

Include a charitable trust in your will or living trust that pays your beneficiaries for life. The Foundation receives the remainder.

Dual-Benefit Gifts

Charitable Gift Annuity

Give cash or securities to fund a gift annuity and receive fixed payments for life. The Foundation receives the remainder.

Charitable Remainder Trust

Transfer cash or appreciated property to fund a trust that sells your property and provides you with payments for life or a term of years. The Foundation receives the remainder.

Charitable Lead Trust

Transfer cash or property to fund a trust that makes gifts to the Foundation for a term of years. Your family receives the remainder.

Retained Life Estate

Give your property to the Foundation but retain the right to use the property during your life or the life of a beneficiary.

Part Unitrust, Part Sale

Deed a portion of your real estate into a charitable remainder trust. After the property is sold, you receive your portion of the proceeds, and your trust receives its share.

Bargain Sale

The Foundation purchases your property for less than fair market value. Your gift is the difference between the market value and the purchase price.

Named Endowments

The journey to establishing the SACS Foundation began with an anonymous gift in 2012, which created the SACS Scholarship Fund. In 2015, these assets were transferred to the SACS Foundation to ensure ongoing scholarship support for families with limited income.

As of April 11, 2024, the SACS Foundation endowment has grown to $765,195 thanks to the generosity of our donors. We are deeply grateful for their contributions, which provide enduring support for our mission.

Below is a list of SACS Foundation endowment funds with an eventual value of $100,000 or more.

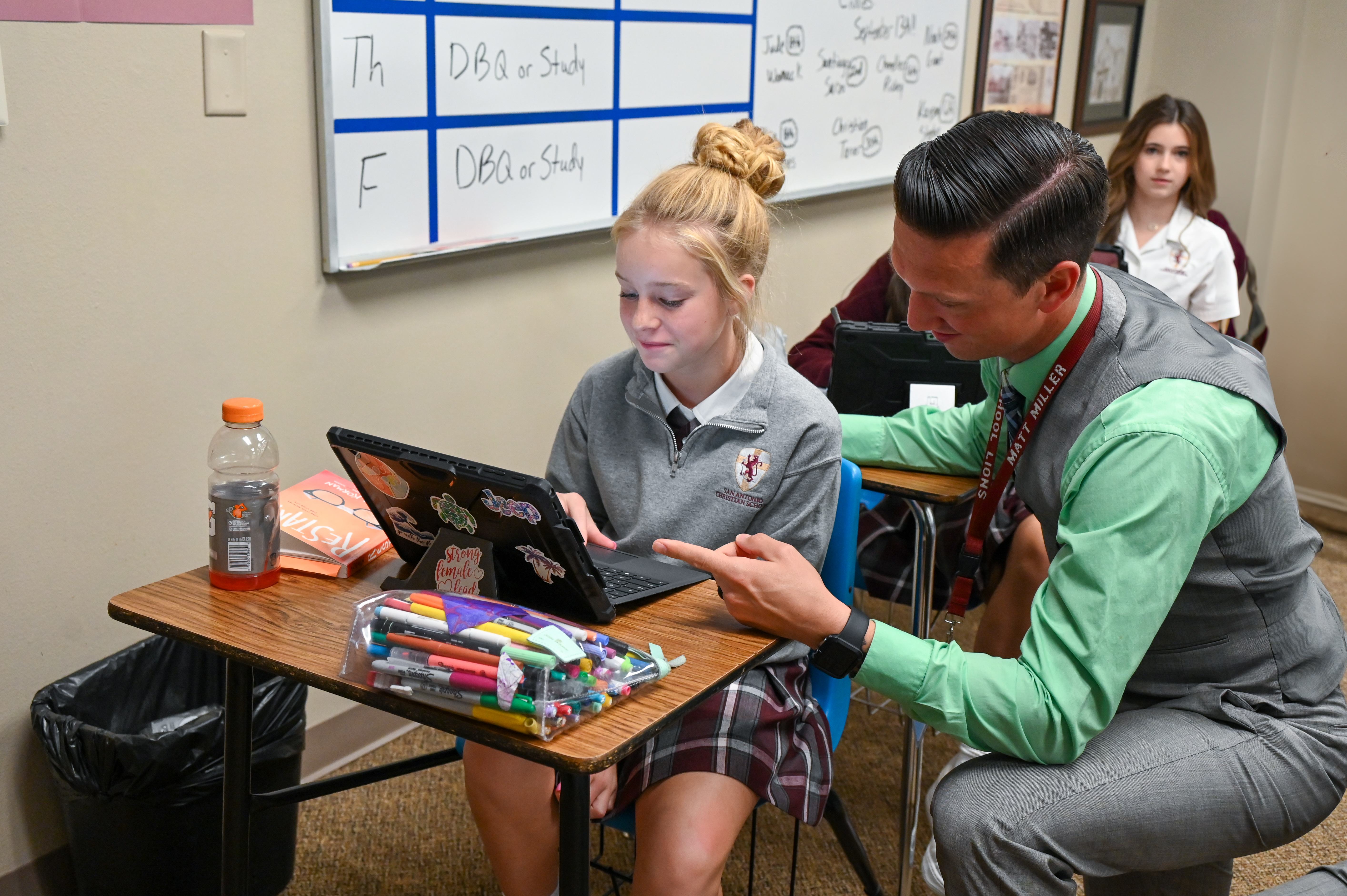

The Bruce and Kathleen Johnson Mathematics Faculty Endowment funds continuing education for SACS math instructors, equipping them to prepare students for advanced college-level math.

The Frost Faculty Chair fund was established in 2018 to help SACS retain and reward its most successful faculty members.

The SACS Scholarship Fund, established by an anonymous gift in 2012, provides vital scholarship support to help families with limited income access a Christ-centered education.

SACS Foundation Board members

The primary objectives of the SACS Foundation Board Members are attracting, receiving, stewarding, investing, managing, and expending gifts designated for the benefit of San Antonio Christian School.

Members

Pat Frost, David Youngdale, Elliot Goudge, Janet Green

Foundation and Development Director

Lydia Adams

Phone

210-248-1636

Email

ladams@sachristian.org

Office

19202 Redland Road (Building Z)

San Antonio, Texas 78259